are funeral expenses tax deductible in australia

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Deductions you can claim.

Eight Things You Need To Know About The Death Tax Before You Die

You cant take the deductions.

. Are funeral expenses tax deductible in Australia. The federal estate tax also limits deductions for funeral expenses to the extent that theyre allowable under state law. If the executors commissions legal fees and other administrative expenses are claimed as an estate tax deduction they cannot be considered a deduction on your.

In short these expenses are not eligible to be claimed on a 1040 tax form. Deductible medical expenses may include but are not limited to the following. Qualified medical expenses must be used to prevent or treat a medical illness or condition.

Qualified medical expenses include. If the IRS requires the decedents estate to file an estate tax return the estates representative may be able to include funeral expenses as a deduction. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction.

What funeral expenses are tax deductible. Yes funeral expenses are a personal expense so the family or the trust cant claim them. Many estates do not actually use this deduction since most estates are less than the amount that is taxable.

A single person with a taxable income of less than 88000 can claim 20 of net medical expenses over 2162. When completing your tax return youre able to claim deductions for some expenses. An individual who pays funeral expenses does not receive tax deductions.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. Only the estate of the deceased receives tax deductions for funeral expenses. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

Most are work-related expenses. Ineligible expenses include venue hire or catering for a wake and headstonememorial costs. Individuals cannot deduct funeral expenses on their income tax returns.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. In other words funeral expenses are tax deductible if they are covered by an estate. According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return.

While the IRS allows deductions for medical expenses funeral costs are not included. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Mar 20 2020 You may be eligible for a compassionate release of super for funeral or.

This means that you cannot deduct the cost of a funeral from your individual tax returns. Funeral expenses are not tax deductible because they are not qualified medical expenses. Any family members out-of-pocket expenses for your funeral will not receive tax deductions.

This guide will explain when funeral expenses are tax-deductible which ones qualify and how to claim. Rules for Claiming Funeral Expense Tax Deductions. There are a few exceptions though including final medical expenses and costs incurred by the decedents estate.

Unlike any other expense funeral expenses cant be deducted for income tax purposes whether the money is spent directly by a person or by the estate. Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the executor of the estate must file an estate tax return and itemize the expenses in order to claim the deduction. This should be an itemized list that includes all the funeral expenses plus the total cost of the funeral.

Generally funeral expenses cannot be deducted for income tax purposes whether they are paid directly by the individual or through the estate as. Polls fees and parking associated with receiving medical treatment. While the IRS allows deductions for medical expenses funeral costs are not included.

The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate. The IRS is only bound by decisions of a states highest court so its possible to have amounts permitted as funeral expenses by the county Orphans Court yet have the deduction denied by the IRS for the federal estate tax. We translate some common expenses in other languages to help people from non-English speaking backgrounds.

Note that the deduction cant be taken on both. The taxes are not deductible as an individual only as an estate. Individual taxpayers cannot deduct funeral expenses on their tax return.

They are never deductible if they are paid by an individual taxpayer. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. Report your funeral and administrative expenses on Form 706 Schedule J.

Any deductible expenses incurred after the date of death. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. To claim medical expenses on your tax return you must itemize your tax.

To find out what guides are available. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. In the context of an individuals income tax returns Form 1040 funeral and burial expenses are not treated as qualified expenses in the same way as business and medical expenses Mechaly said.

Mar 20 2020 burialcremation fees including coffin casket or urn. Can funeral expenses be claimed on taxes as a medical expense deduction for an immediate family member or dependent who has recently passed away. Deducting funeral expenses as part of an estate.

In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible. Funeral Costs as Qualifying.

According to Internal Revenue Service. Aside from floral cost the cost of funerals including cremation casket hearse limousines and embalming is deductible for all funeral expenses including funeral urns. These are costs you incur to earn your employment income.

An estate tax deduction is generally allowed for funeral expenses including the cost of a burial lot and amounts that are expended for the care of the lot. Not all funeral expenses can be deducted and some charges may be denied by the. An itemized funeral expense list will allow you to deduct money spent on funeral expenses such as embalming cremation casket storage hearses limousines and florals.

In short these expenses are not eligible to be claimed on a 1040 tax form. Are Cremation And Funeral Expenses Tax Deductible.

Tips For Filling In Your Tax Return As A Higher Rate Or Additional Rate Taxpayer Financial Times

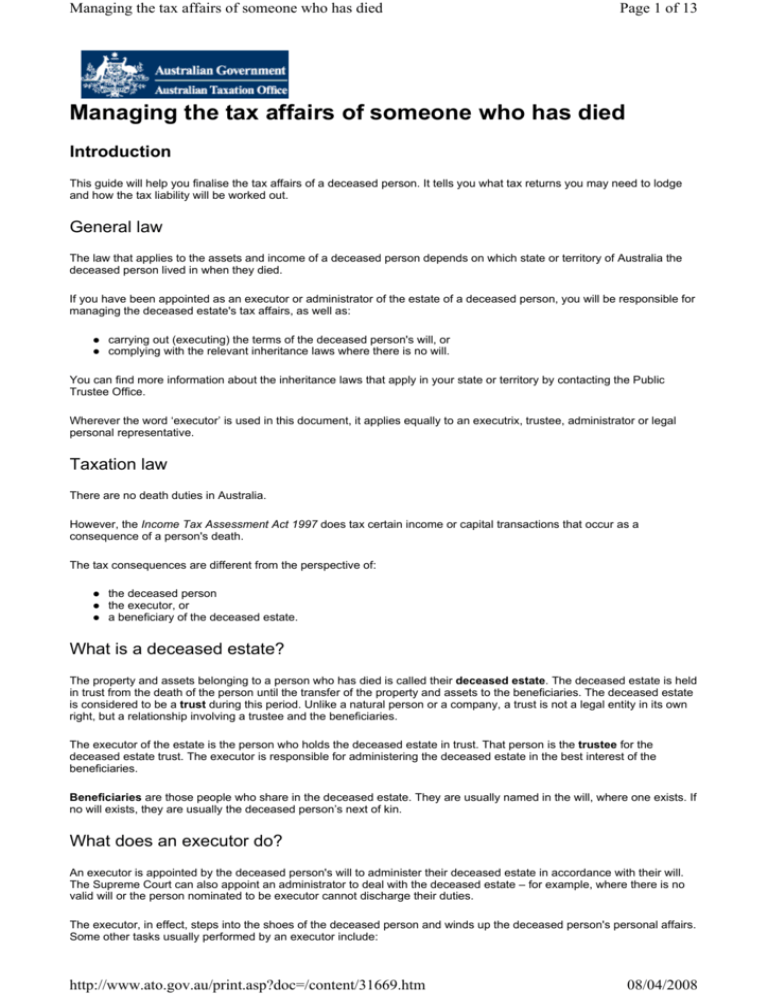

Managing The Tax Affairs Of Someone Who Has Died Ato Fact Sheet

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Are Funeral Costs Tax Deductible In Australia Ictsd Org

11 Types Of Tax Incentives How They Differ In Their Functionality Income Tax Income Tax Return Tax Refund

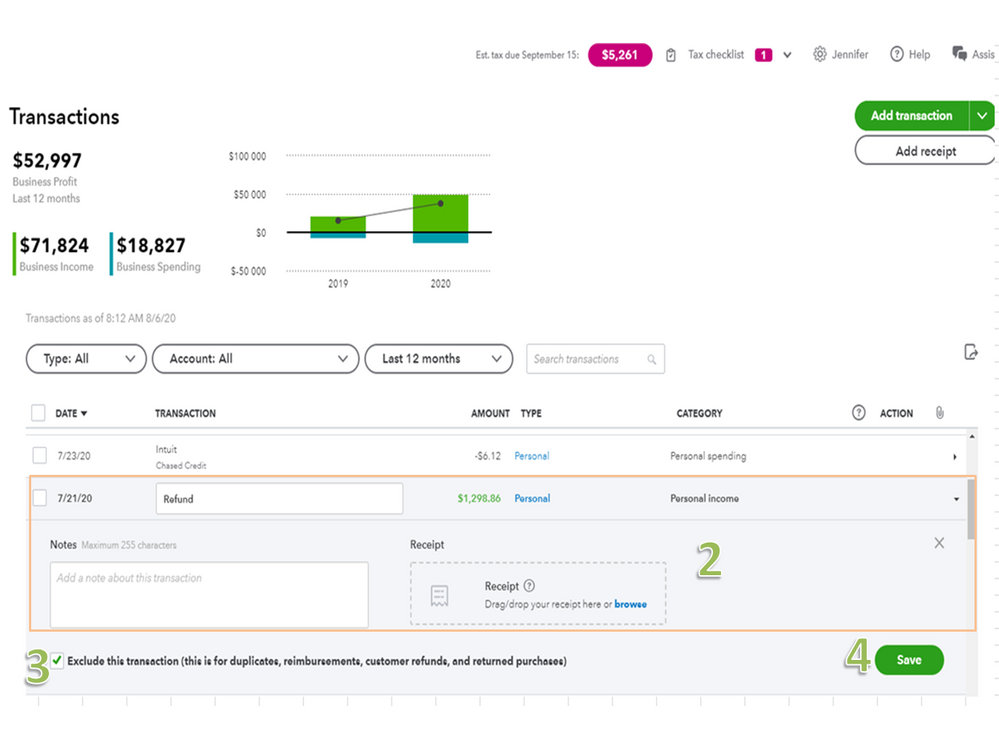

How Do I Record Category Transactions That Are Ref

What Are Non Deductible Expenses Rydoo

Are Funeral Costs Tax Deductible In Canada Ictsd Org

Lawn Business Tax Write Offs Lawn Love

A New Tool To Help You Track Rent Payments Rent Payment Helpful

Turbotax Deluxe 2021 Tax Software Federal And State Returns Federal E File State E File Additional Mac Download E Delivery Costco

Inheritance Tax Changes Estate And Gift Tax Tax Notes

How Much Should You Donate To Charity District Capital

Are Funeral Costs Tax Deductible In Australia Ictsd Org

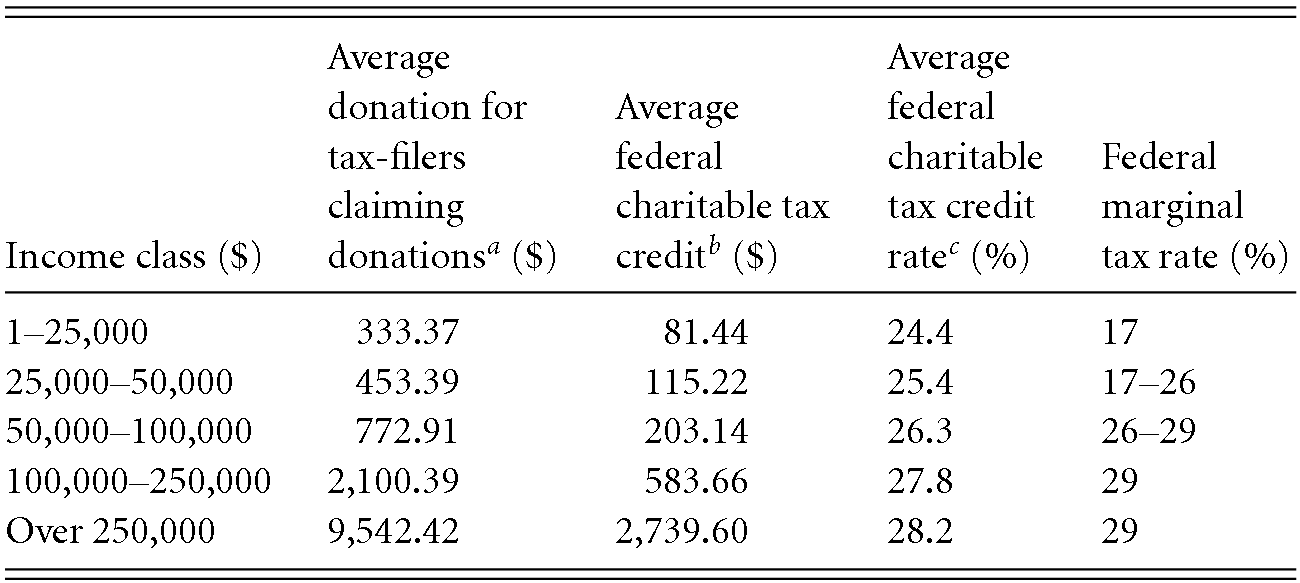

Taxation Part Iii Not For Profit Law

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service